Extra taxes on the Wealthy Elite and Pollution should be used to fund more housing and other public services.

| Ordinary Australians 95% LESS TAX | The Wealthy Elite 5% MORE TAX |

|---|---|

| Ordinary workers, students, renters & pensioners | Billionaires, speculators, foreign multinationals & scammers |

| Zero or one Property | Multiple Properties |

| Ordinary house, ordinary car | Luxury mansions, cars, yachts |

| High rent or mortgage costs | No mortgage, no rent |

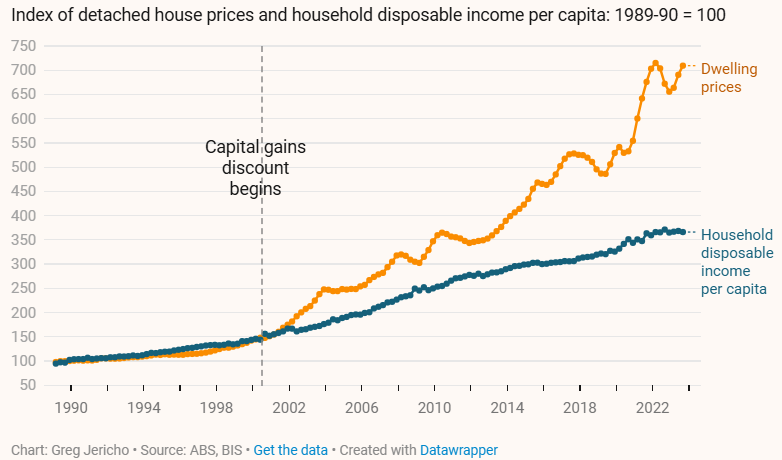

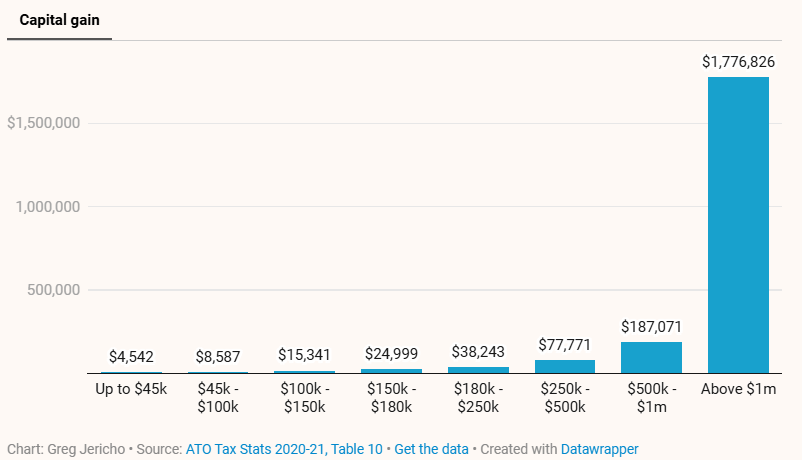

| No CGT Discount1 | Exploiting CGT Discount |

| Few direct shares | Large shareholdings |

| No Franking Credits2 | Exploiting Franking Credits |

| Government schools | Elite private schools |

| Super | Crypto |

Tax & Spending Reforms

| Proposed spending | Proposed funding |

|---|---|

| ➧ More Housing | ➧ Scrap Negative Gearing and the CGT discount (except on new housing)* Saving: $20 Billion per annum ➧ Allow investors to put cash from the sale of housing into super – for 12 months. ➧ No housing in SMSF’s. |

| ➧ More cost effective defence ➧ More housing, medicare, education, transport, etc. | Scrap AUKUS nuclear submarines, scrap the new frigates. Saving: $368 Billion+ |

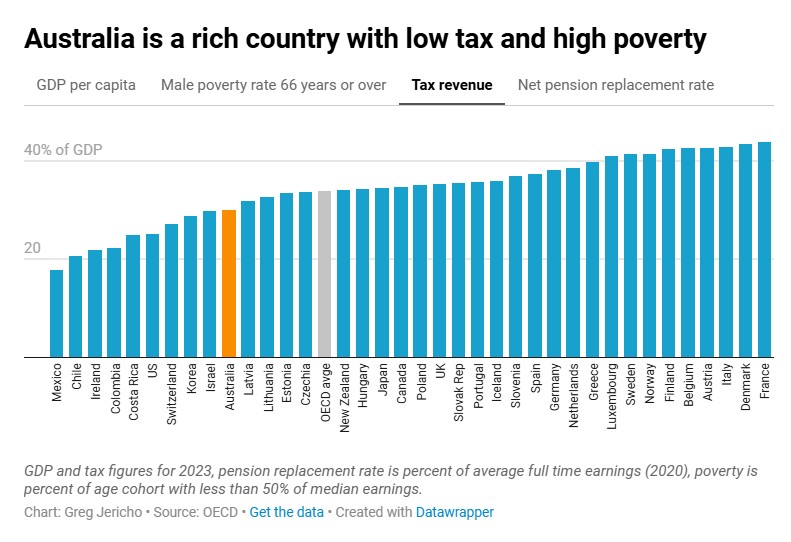

| ➧ $3,000 Low & Middle Income Earner Tax Offset (LMITO) (Brings back the LMITO the Liberals scrapped in 2022) | ➧ More tax on fossil fuel exports ➧ More tax on high incomes* ➧ Cut dodgy deductions and rebates ➧ Crackdown on fake charities, crypto and cults |

| ➧ More Medicare | ➧ Cap Franking Credits to exclude the top 20% ➧ Junk Food Tax ➧ A 25% tax on gas exports from Commonwealth waters |

| ➧ More Public Education | Less funding for wealthy elite schools* |

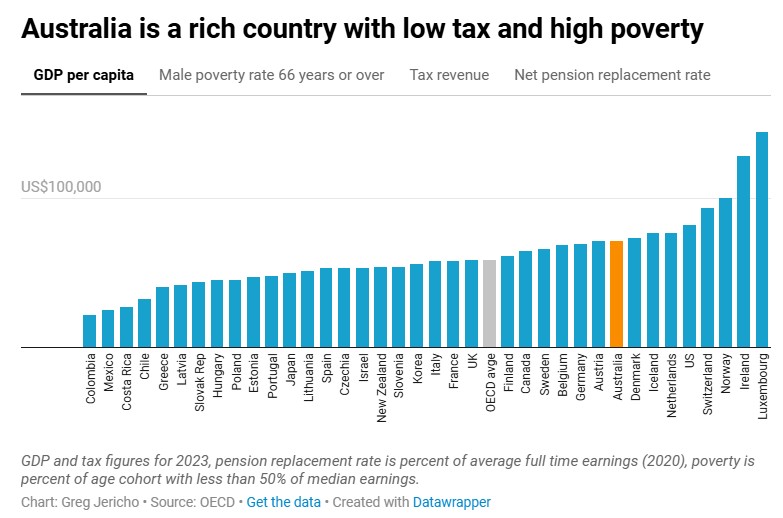

| ➧ More Science | Wealth taxes (Australia Institute) |

| ➧ Less Tax on EV’s | More tax on fossil vehicles |

| ➧ Heavy vehicle and farm electrification subsidies | Redirect the $10 billion diesel fuel subsidy to support electrification |

| ➧ Apply GST to Private School Fees and Private Health Insurance | More funding for public education and Medicare. |

| ➧ Higher pensions & job seeker allowances | Less superannuation tax breaks for balances over ~$1 million + CPI |

| ➧ FREE Australian Driver’s Licences | ➧ Funded by an increase in fuel excise. ➧ Revenue directed to the States if they abolish their State driver’s licences & registration. |

| ➧ FREE Australian Vehicle Registration | ➧ Funded by an increase in fuel excise. ➧ Medicare enhanced to cover traffic accident injuries. ➧ Centrelink payments enhanced to handle Loss of Income from accident injuries. |

| ➧ FREE Australian Passports | Funded by an increase in fuel excise on aviation fuel. |

(*Will vary for Conservative Electorates – see One Country, Two Systems)

References

- Who benefits from negative gearing (PDF, Australia Institute)

- Who benefits from Franking Credits (Australia Institute)

- Cheapest power generation (Guardian)

- Previous Low and Middle Income Tax Offset (ATO)

- IMF says scrap GGT discount (Nine)

- Billions lost by not taxing gas (Ross Gittins)

- Sally McManus’s tax reform proposals (Guardian)

- ACCOSS 2018/19 Tax cuts benefit the wealthy (PDF)

- Tax reform isn’t hard – slug multinationals and subsidise the things we want more of (Australia Institute)

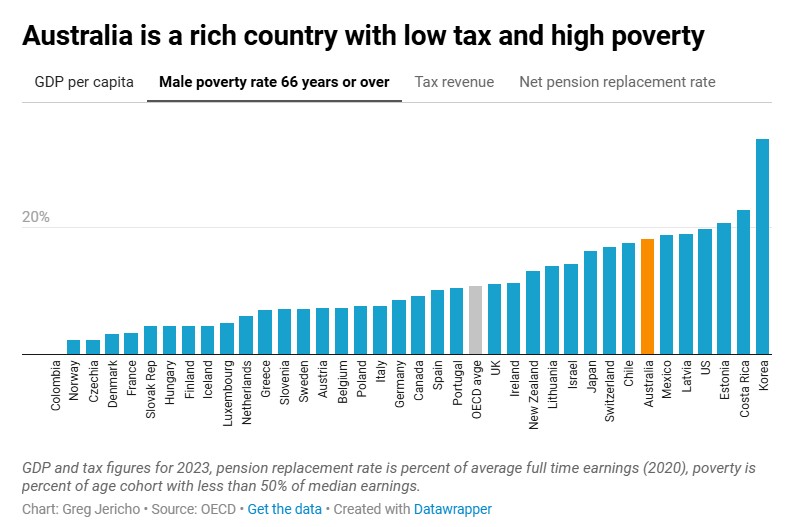

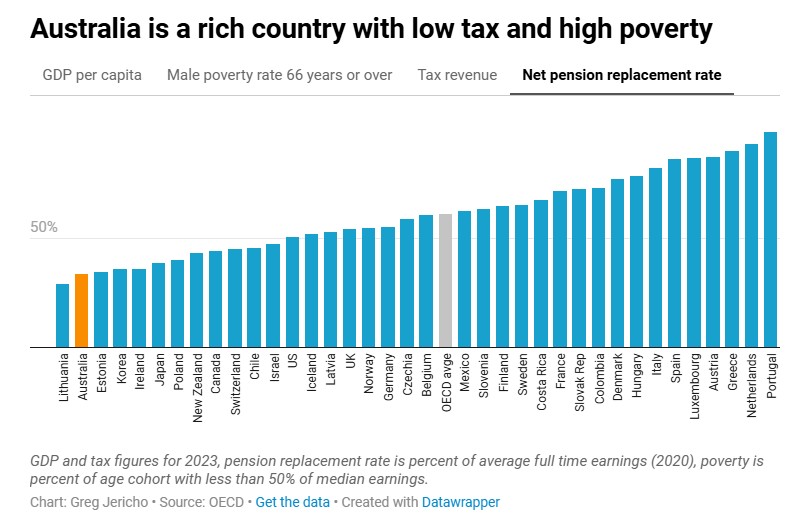

- If we want a better, more equal society, we need more tax. But more tax only works if big business pays their fair share (Greg Jericho, Guardian)

- Health funding is one of our trickiest issues – here’s a politically sweet fix (Australia Institute)

- The LMITO and stage 3 tax cuts by electorate (Australia Institute – PDF)