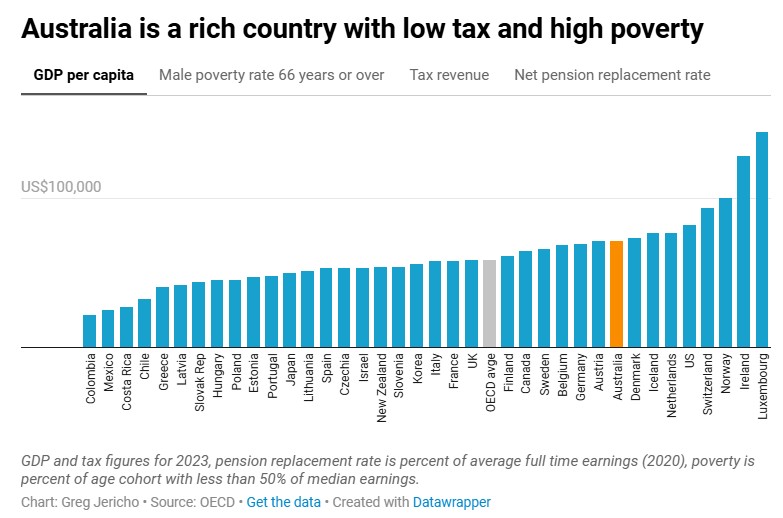

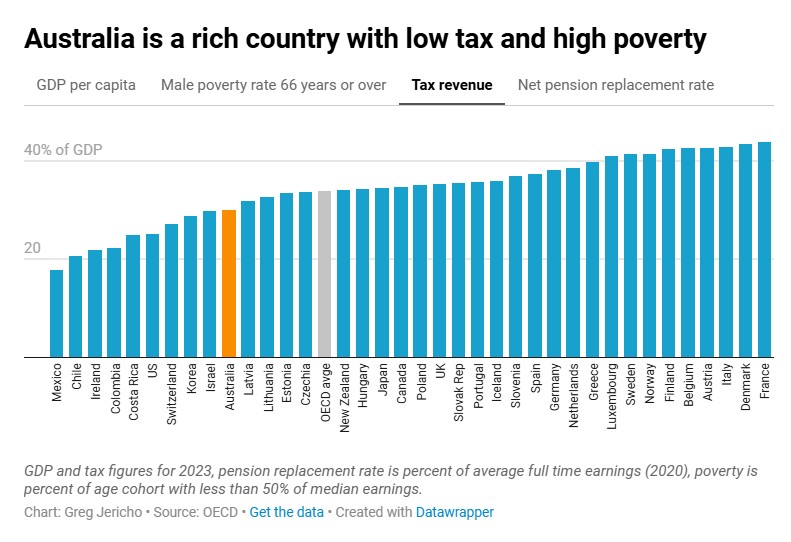

Extra taxes on the Wealthy Elite and Pollution should be used to fund more housing and other public services.

The objective is to lift Australia’s Better Life Index rating which lags behind many OECD countries.

Tax & Spending Reforms

| SPENDING / TAX CUTS | FUNDING |

|---|---|

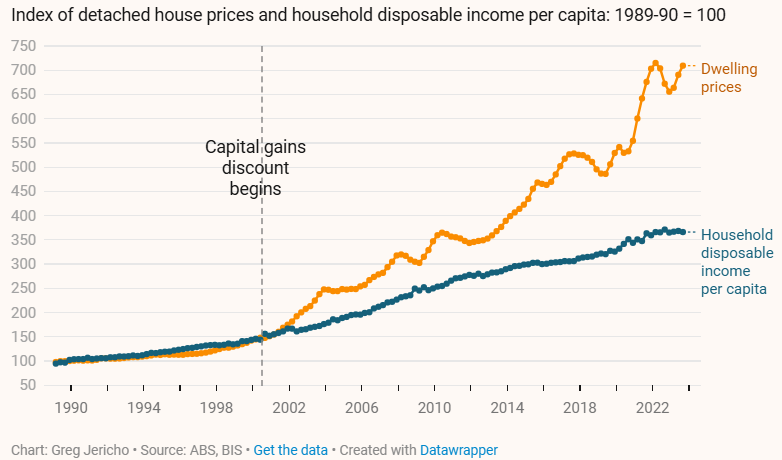

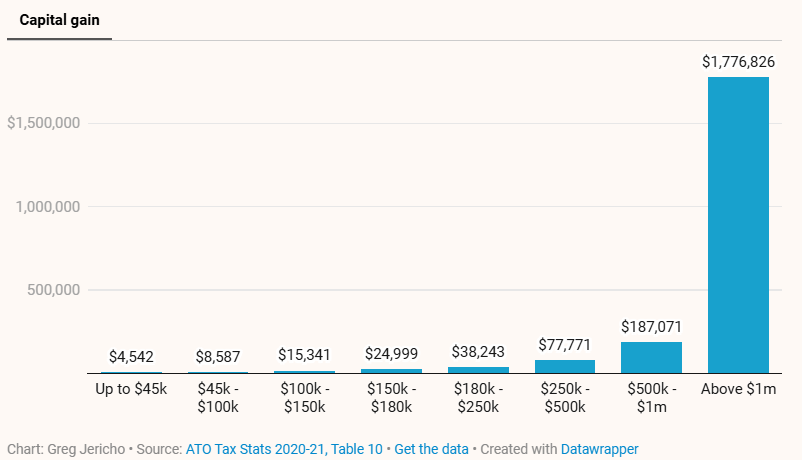

| ➧ More Housing | ➧ Scrap Negative Gearing and the CGT discount (except on new housing)* Saving: $20 Billion per annum ➧ Allow investors to put cash from the sale of housing into super – for 12 months. ➧ No housing in SMSF’s. |

| ➧ More cost effective defence ➧ More housing, medicare, education, transport. | ➧ No nuclear submarines, no new warships. Saving: $368 Billion+ |

| ➧ $5,000 Low & Middle Income Earner Tax Offset (LMITO) (Brings back the LMITO the Liberals scrapped in 2022) | ➧ More tax on fossil fuel exports including 25% tax on exported gas (raising $17 billion) ➧ Tax on industrial-scale use of fresh water for data centres, mining, etc. ➧ More tax on high incomes* ➧ Cut dodgy deductions and rebates ➧ Crackdown on fake charities, crypto and cults ➧ Tax on guns and ammunition (except livestock farmers. ➧ Tax on unmoderated social media platforms that allow hate speech |

| ➧ More Medicare | ➧ Cap Franking Credits to exclude the top 20% ➧ Junk Food Tax ➧ A 25% tax on gas exports from Commonwealth waters |

| ➧ More Public Education | ➧ Less funding for wealthy elite schools* |

| ➧ More Science | ➧ Wealth taxes (Australia Institute) |

| ➧ Less Tax on EV’s | ➧ More tax on fossil vehicles |

| ➧ Heavy vehicle and farm electrification subsidies | ➧ Redirect the $10 billion diesel fuel subsidy to support electrification |

| ➧ Apply GST to Private School Fees and Private Health Insurance | ➧ More funding for public education and Medicare. |

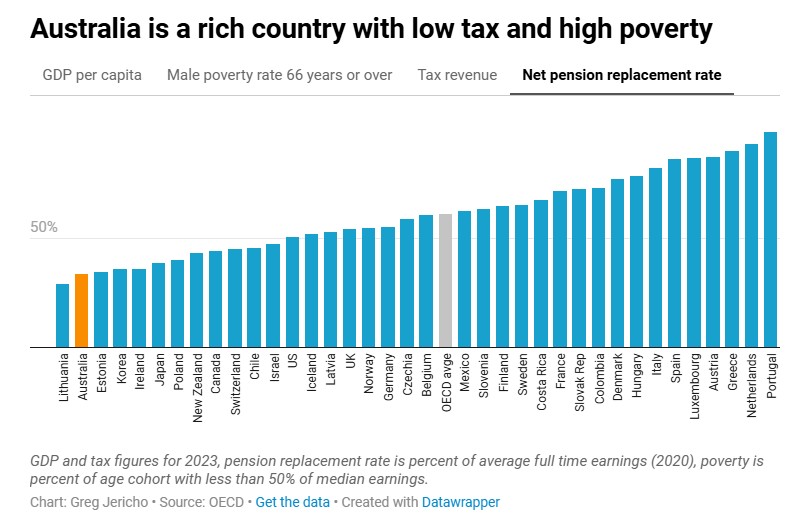

| ➧ Higher pensions & job seeker allowances | ➧ Less superannuation tax breaks for balances over ~$1 million + CPI |

| ➧ FREE Australian Driver’s Licences | ➧Slight increase in fuel excise. ➧Revenue directed to the States if they abolish their State driver’s licences & registration. |

| ➧FREE Australian Vehicle Registration (May need to discourage bull bars etc.) | ➧ Increase in fuel excise. ➧ Medicare enhanced to cover traffic accident injuries. ➧ Centrelink payments enhanced to handle Loss of Income from accident injuries. |

| ➧ FREE Australian Passports | ➧ Increase fuel excise on aviation fuel. |

| ➧ Lower State Payroll Taxes – More jobs | ➧ Higher State Land Taxes (Encouraged via changes to State grants rules) |

(*Will vary for Conservative Electorates – see One Country, Two Systems)

Standardization of State Taxes

We would examine standardization of State taxes such as Land Tax.

Revenue would continue to flow to the States but all the States would have the same rates and rules.

This might be achieved through reform of the grants process – less grants to non-compliant States.

The idea would be to avoid State governments entering a ‘race to the bottom’ on company taxes.

We favour State taxes on the unimproved land value as a revenue source rather than Payroll Taxes as Land Tax is highly efficient and difficult to avoid. This has to be implemented at the State level.

Government Insurance

A Government Insurance scheme may be needed to cover complete loss of structures if insurance becomes unviable.

This would need to be funded by a land tax.

References

- Who benefits from negative gearing (PDF, Australia Institute)

- Who benefits from Franking Credits (Australia Institute)

- Cheapest power generation (Guardian)

- Previous Low and Middle Income Tax Offset (ATO)

- IMF says scrap GGT discount (Nine)

- Billions lost by not taxing gas (Ross Gittins)

- Sally McManus’s tax reform proposals (Guardian)

- ACCOSS 2018/19 Tax cuts benefit the wealthy (PDF)

- Tax reform isn’t hard – slug multinationals and subsidise the things we want more of (Australia Institute)

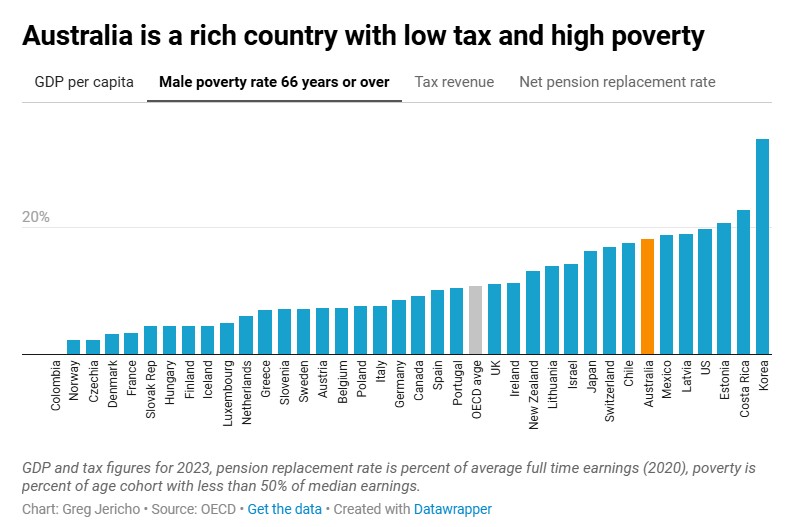

- If we want a better, more equal society, we need more tax. But more tax only works if big business pays their fair share (Greg Jericho, Guardian)

- Health funding is one of our trickiest issues – here’s a politically sweet fix (Australia Institute)

- The LMITO and stage 3 tax cuts by electorate (Australia Institute – PDF)

- The great gas rip off (Australia Institute)

- Nothing sweet about the tax system (The Age, Dec 2025)

Prosper Australia’s Tax Shift